Corning Reports Strong Q1 2025 Results 2025-05-05 Carol

Corning Incorporated (NYSE: GLW) today announced its first-quarter 2025 financial results and provided an outlook for the second quarter. Wendell P. Weeks, Chairman and Chief Executive Officer, said: "First-quarter performance exceeded expectations, with core sales growing 13% year-over-year. Enterprise business achieved a 106% increase due to strong demand for generative AI products. We remain confident in achieving the 'Springboard plan' and are accelerating the ramp-up of production capacity for AI data center innovation products and US-manufactured solar products."

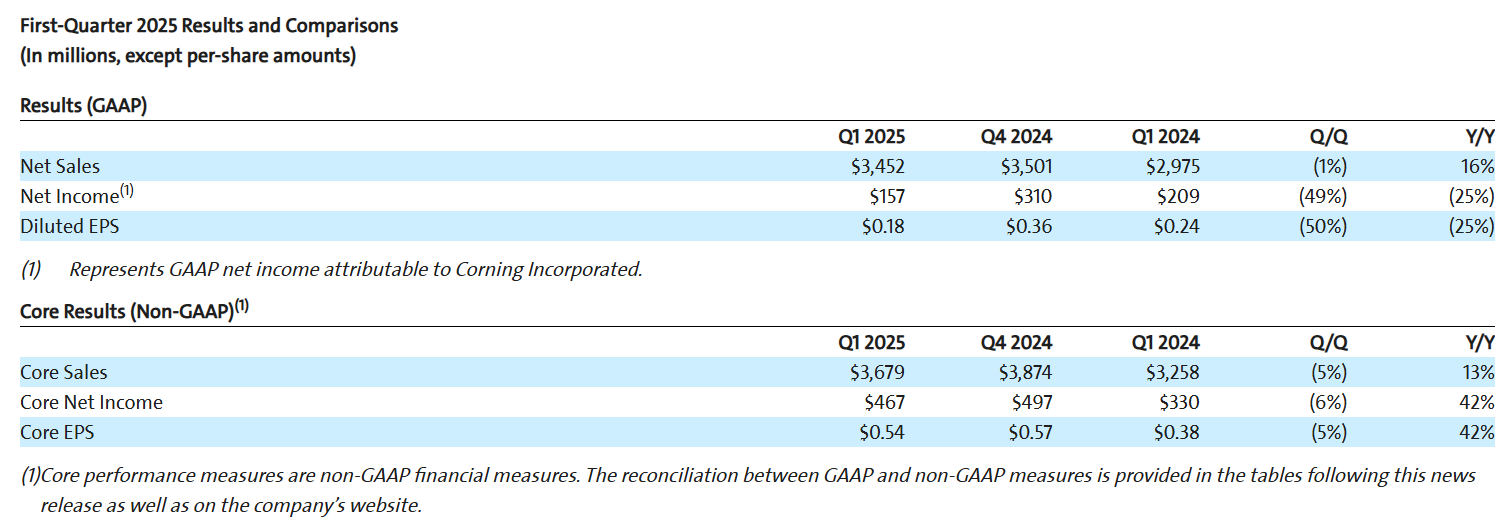

Financial data shows that first-quarter GAAP sales were $3.45 billion, while core sales reached $3.68 billion; GAAP earnings per share were $0.18, and core earnings per share were $0.54. Core gross margin improved 110 basis points year-over-year to 37.9%. Chief Financial Officer Ed Schlesinger noted: "Operating profit margin expanded by 250 basis points. We expect second-quarter core sales of approximately $3.85 billion, with earnings per share ranging from $0.55 to $0.59. Current tariffs impact earnings per share by about $0.01 to $0.02, and the ramp-up of AI and solar product production brings a temporary cost increase of $0.03."

The Optical Communications business performed strongly, with first-quarter sales of $1.36 billion, up 46% year-over-year, including a doubling of enterprise network business. The company has raised its expected compound annual growth rate for enterprise sales from 25% to 30% for the period from 2023 to 2027. Carrier network business is expected to return to growth in 2025 as demand for data center interconnect products recovers.

Regarding tariff impacts, Corning stated that its "nearby production" strategy forms a natural hedge: nearly 90% of US market revenue comes from domestic production, 80% of China sales are produced locally or in duty-free zones, and only about 5% are imported from the US and subject to tariffs. It is expected that second-quarter tariffs will directly impact earnings by approximately $10 to $15 million, which will be further mitigated through supply chain optimization and price adjustments.

Weeks emphasized: "Even in the face of a macroeconomic downturn, we remain confident in achieving the $4 billion 'Springboard plan.' Growth drivers come from long-term trends such as AI data centers and renewable energy, as well as the increasing 'more Corning' content in customer products." The company is currently accelerating the construction of advanced US manufacturing bases to meet the strong demand for domestic solar products.

Original Link:https://investor.corning.com/news-and-events/news/news-details/2025/Corning-Announces-Strong-First-Quarter-2025-Financial-Results1-and-Reiterates-Confidence-in-Springboard-Plan/default.aspx