PON Market: Current Downturn, Future Opportunities, and Survival Strategies for Enterprises 2025-09-29 Carol

Today, the data center market driven by AI is booming, while the access network PON (Passive Optical Network) market seems lackluster. Recently, network equipment provider Ciena announced a strategic shift, stating it will halt PON research and development and focus on optical and data center network technologies for AI and cloud services. Ciena's move to cut its PON business undoubtedly makes the current PON market even more challenging. Why is the PON market in a slump, and is there still room for growth in this market in the future? How should enterprises in the PON business survive and develop? Recently, CFOL visited multiple enterprises in the PON industry chain, mostly those engaged in PON OSA (Optical Sub-Assembly) production, to understand their current situation.

Development of PON Technology

Currently, in terms of speed, the global FTTx market demand is still dominated by 2.5G. Demand for 10G PON has also peaked, while 50G PON is still in the pilot phase. Looking back at history, the PON industry began to develop in the 1980s and has undergone multiple rounds of technological iteration, gradually evolving from narrowband to high-speed and from single-standard competition to multi-technology integrated evolution:

Market Downturn and Demand Data

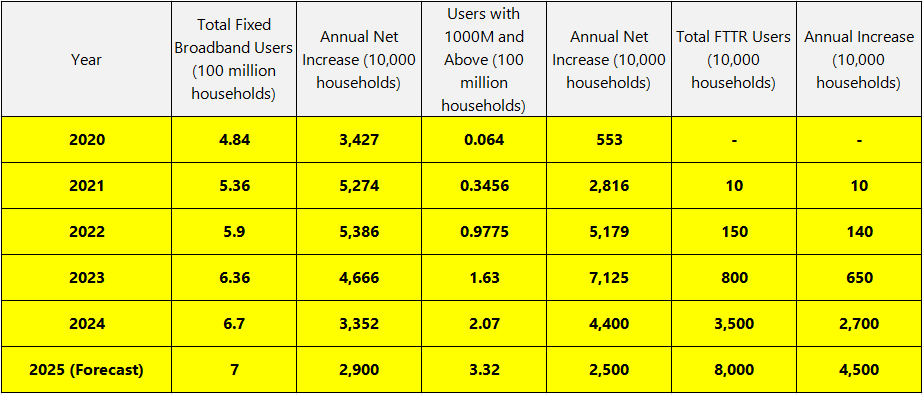

The PON market has been in a downturn since peaking in 2023, showing sluggishness from last year to the present. Terminal demand is a key factor affecting the market, as changes in demand directly impact operators' equipment procurement decisions. Based on public data from the Ministry of Industry and Information Technology, the following table compiles statistics on the total number of fixed Internet broadband access users and the number of users with access rates of 1000Mbps and above for China's three major operators over the past five years (2020–2024):

Note: Fixed network access here includes home broadband, enterprise broadband, and other types of broadband access. The "annual net increase" refers to the net value of new users minus lost users, and some broadband upgrade users are not included. According to Hexian Research, starting from 2022, new and upgraded users have mainly focused on access rates of 1000M and above. Compared with previous years, the net increase in fixed network access and the growth in gigabit network users in 2024 and the forecast for 2025 have both declined, but the decline is not significant. However, the annual growth in FTTR (Fiber To The Room) users is substantial. Based on the configuration that one FTTR user requires at least 2 ONU devices, the demand in the PON market in 2024 and 2025 can basically remain flat with that in 2023, though there is no growth (using ONU devices as the comparison standard).

Industry Dilemma and Enterprise Survival Strategies

Although market demand has not decreased, enterprises in the PON industry chain are struggling to survive—especially those producing OSA devices, which generally have meager or even non-existent profit margins. As the marketing director of a well-established PON device enterprise put it: "For companies making PON devices now, if product scrap rates are well controlled, there’s still some profit; if not, it’s basically like working for free." When it comes to cost and yield control, the first thoughts are usually moving factories to cities with cheaper labor in outer suburbs and improving production automation. However, even after doing both, enterprise profitability remains limited. The root problem lies in extremely low product pricing and severe oversupply in the industry chain, which keeps prices falling.

According to the above statistics and forecasts, the total demand for PON devices in China in 2025 will be less than 150 million units. According to public information from enterprises, in 2025, MTC’s BOSA production capacity will reach 100 million units, and Fujian Zhongke’s BOSA production capacity will reach 120 million units. The combined capacity of just these two enterprises can meet the entire domestic PON market’s demand for OSA devices. Is there really no room for small enterprises under the shadow of these "giants"? How can other small and medium-sized enterprises producing PON optical devices survive?

1. Expand Overseas Markets

Domestic price competition is too fierce. During discussions, many enterprises mentioned exploring overseas markets. At the 2024 Munich Shanghai Optical Expo, Mr. Liao from Ushine Optics told the editor, "We want to expand into overseas markets because we really don’t want to get stuck in domestic price wars." Some enterprises that acted early reported that overseas markets have contributed to their revenue.

2. Enter Non-Communication Markets

Exploring applications in fields such as lidar, sensing, and industrial lasers is a strategy many device manufacturers have been pursuing. They generally believe that although non-communication applications have smaller volumes, they offer higher prices and better profits, making them worth developing.

3. Vertically Integrate the Supply Chain

Li Song, head of Xiamen Sanyou’s Xi’an office, told the editor: "For PON devices, materials account for the largest share of total costs. To improve profit margins, enterprises should make the supply chain as self-sufficient as possible—after all, every supplier needs to make money." Currently, Sanyou Optoelectronics has mass-produced chips for its own optical splitter detector (Tap Pd) products and is already supplying them to external customers. Recently, Sanyou Optoelectronics will hold a new product launch event for this. Chengdu Aojie also produces the pigtail part of its pigtailed BOSA in-house. The so-called "vertical integration" here means enterprises extend slightly upstream or downstream in the supply chain based on their own strengths to control procurement costs.

4. Invest in COB and COC Production Lines

Yuandu Technology’s nearly 8,000㎡ factory in Ankang, Shaanxi focuses on new businesses, including COB (Chip On Board) packaging and devices such as FA-MT and WDM within COB. ChuHan Technology has deeply applied COB technology to the production of PON optical engines and modules. Its COB process covers speeds from 10G to 200G and is compatible with packaging forms such as SFP+ and SFP28.

Conclusion

In summary, demand for 10G PON is already declining, and 50G PON is still in the small-batch stage. In the oversupplied PON device industry, difficult survival is a widespread dilemma. On one hand, there is a price war caused by overcapacity; on the other, enterprises face pressure from leading manufacturers. Small and medium-sized enterprises are especially prone to falling into the vicious cycle of "the more they sell, the more they lose." Of course, various enterprises are actively seeking other survival paths—there are more strategies beyond those listed here. As for who will truly succeed, let’s just "let the bullets fly" for a while.